high low method machine hours

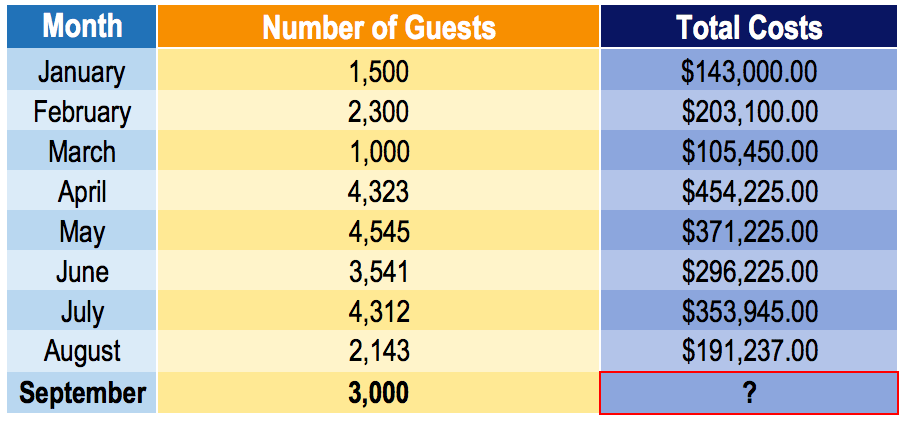

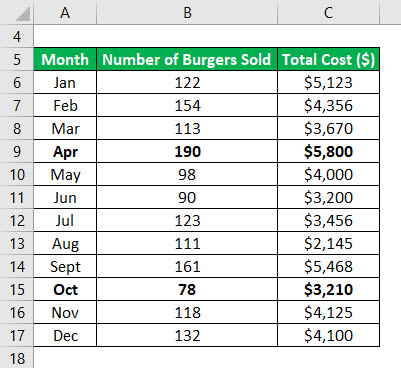

Month Labor-Hours Machine-Hours Overhead Costs. Up to 256 cash back 2.

Coffee Brewing Methods 19 Ways To Brew Amazing Coffee Coffee Brewing Methods Coffee Brewing Coffee Facts

The company observed that at 21000 machine hours of activity total maintenance costs averaged 3620 per hour.

. What total overhead cost would you expect to beincurred at an activity level of 46000 machine-hours. When activity jumped to 25000 machine hours which was still within the relevant range the average total cost per machine hour was 3030. What is the high-low method.

Y 4875 525X c. The company observed that at 12000 machine hours of activity total maintenance costs averaged P700 per hour. Cost Hours 24900 5250 24000 5500 36400 7500 44160 9750 45000 9500 4.

Using the high-low method estimate a cost formula formaintenance in the form Y a bX. Round the variable cost to the nearest cent y 1310 x 162000 Predict total overhead costs if 25 comma 00025000 nursing hours are predicted for the month. Using the high-low method determine the fixed and variable.

Use the following information to answer 127-129. 1 the total dollars of the mixed cost that occurred at the highest volume of activity and 2 the total dollars of the mixed cost that occurred at the lowest. Y 43191 019X b.

The total predicted overhead costs for the month is 489500. Indirect materials variable 56430 pesos Rent fixed 129000 Maintenance mixed 37260. Change in cost Change in volume Variable cost slope 는 - X Data table Round the variable cost to the nearest cent Using the high-low method the variable utilities cost per machine hour is 160 Machine Hours 1050 Requirement 2.

The High and Low Method is a costing method that splits the Fixed and Variable costs by studying cost variability. Y 41900 023X d. Assuming Cosco Company uses the high-low method of analysis if machine hours are budgeted to be 20000 hours then the budgeted total maintenance cost would be expected to be.

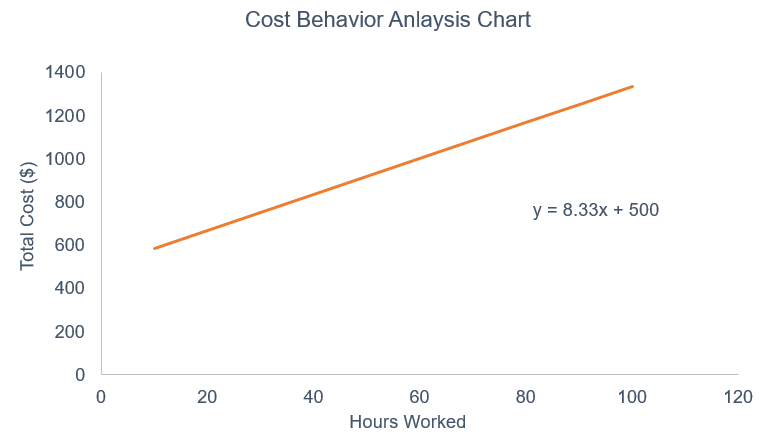

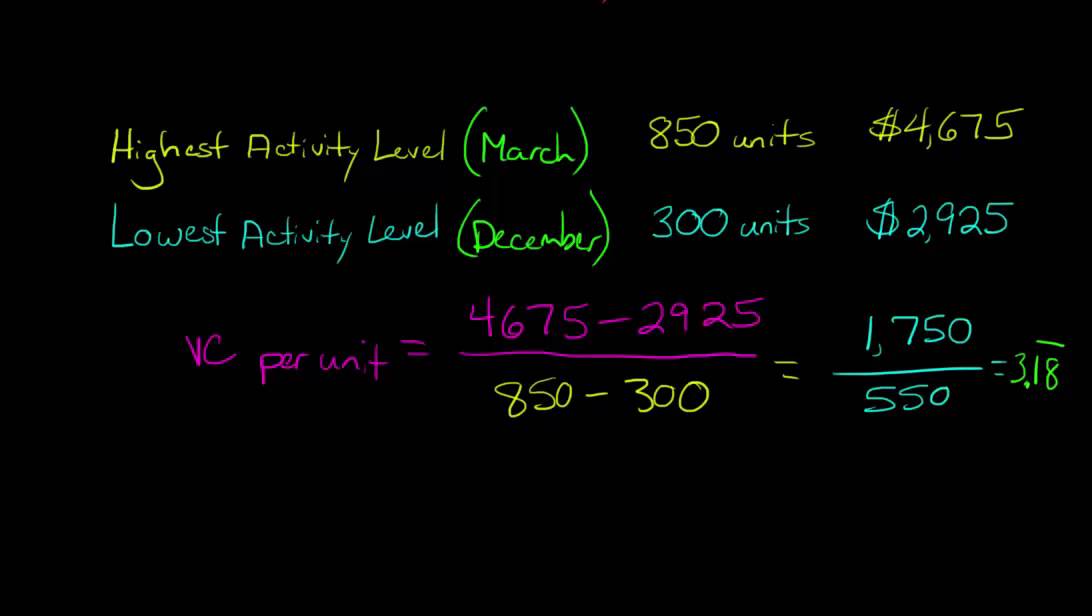

Plant activity is best measured by direct labor hours. A method of measuring cost functions called the high-low method and has decided to use it in this situation. Lets begin by determining the formula that is used to calculate the variable cost slope.

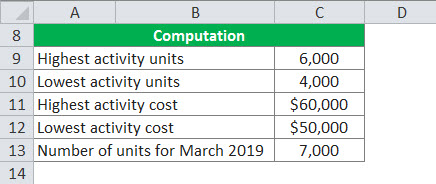

The company observed that at 19000 machine hours of activity total maintenance costs averaged 3750 per hour. The high-low method is a simple technique for determining the variable cost rate and the amount of fixed costs that are part of whats referred to as a mixed cost or semivariable cost. 300000 25000 6000 4000 25 Per Unit.

Hilby Inc uses the high-low method to analyze cost behavior. Express the companyâ s total overhead cost in theform Y a bX. Use the high-low method to determine the hospitals cost equation using nursing hours as the cost driver.

Uses the high-low method to analyze cost behavior. Y 2430 428X Answer. The company observed that at 21000 machine hours of activity total maintenance costs averaged 3620 per hour.

The other more complex method is regression method. The company has analyzed these costs at the 51300 machine-hours level of activity as follows. Though a subjective approach the high and low method is employed for their simplicity.

The companys relevant range of activity varies from a low of 600 machine hours to a high of 1100 machine hours with the following data being available for the first six months of the year. Business Accounting QA Library Hotlanta Inc which uses the high-low method to analyze cost behavior has determined that machine hours best explain the companys utilities cost. What is the cost function.

If 29000 machine hours were budgeted for the next period estimated semi-variable costs would total A. The companys relevant range of activity varies from a low of 600 machine hours to a high of 1100 machine hours with the following data being available for the first six months of the year. Recent data are shown below.

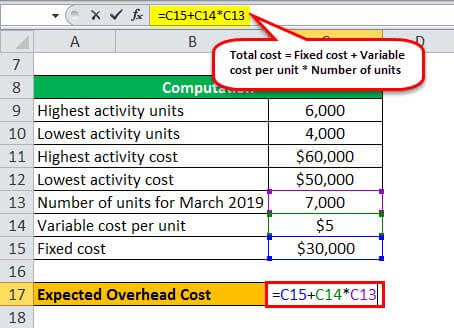

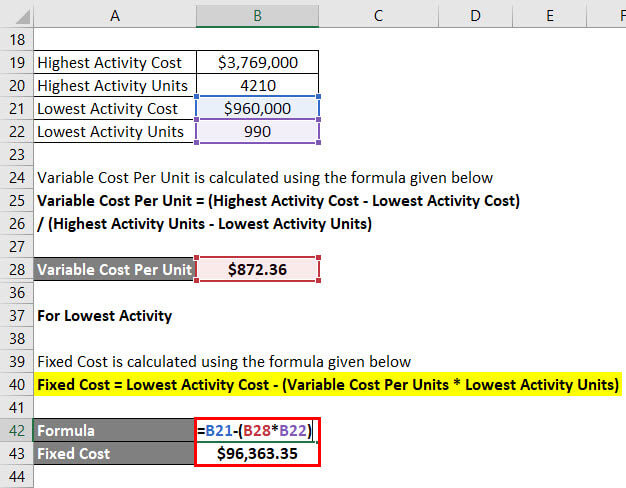

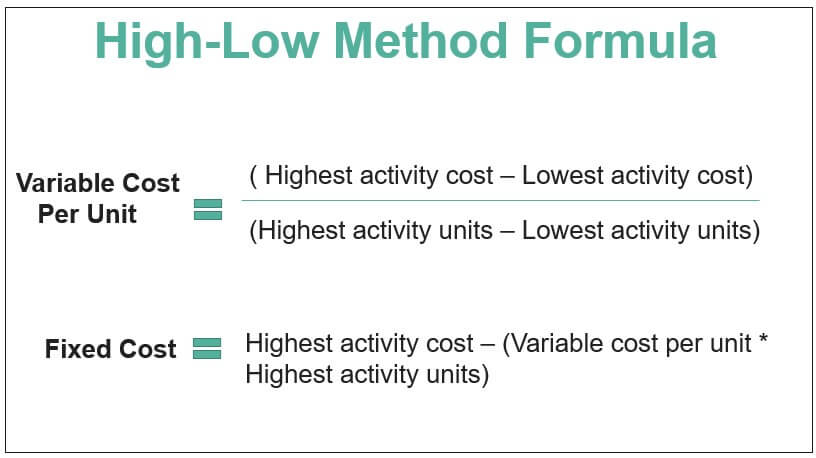

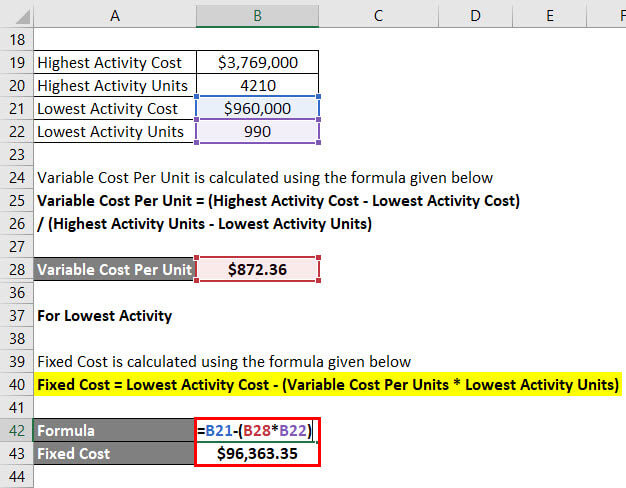

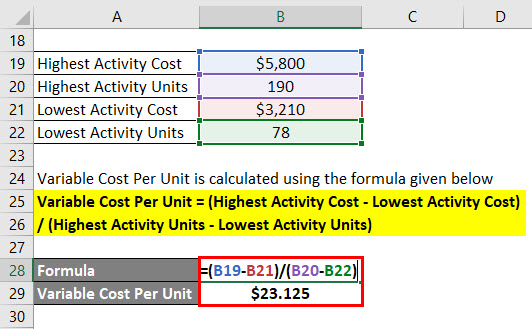

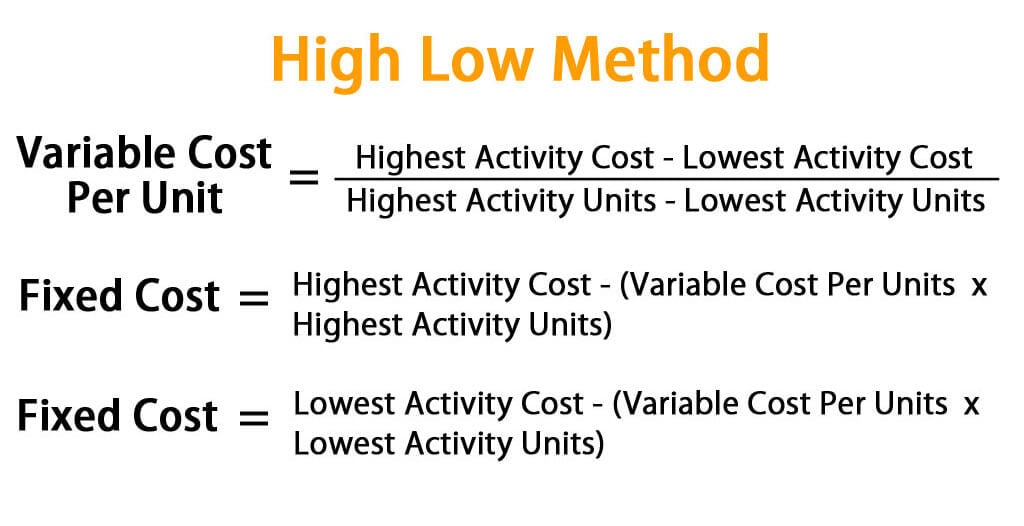

High-low Method is used in Accounting to separate fixed and variable cost element from historical cost that is a mixture of both fixed and variable cost and with the use of the high low formula per unit variable cost is measured by subtracting the cost of lowest activity from the cost of highest activity and dividing the resultant amount from. Difference between highest and lowest activity units and their corresponding costs are used to calculate the variable cost per unit using the formula given above. When activity jumped to 15000 machine hours which was still within the relevant range the average cost per machine hour totaled P640.

When activity jumped to 25000 machine hours which was still within the relevant range the average total cost per machine hour was 3140. Machine-Hours Maintenance Costs Highest observation of cost driver 140000 280000 Lowest observation of cost driver 95000 190000 Difference 45000 90000 Maintenance costs a b Machine-hours Slope coefficient b 90000 45000 2 per machine-hour Constant a 280000 280000 0 or Constant a 190000. Using all of the information above the total cost equation is as follows.

When activityjumped to 25000 machine hours which was still within the relevant range the average total cost per machine hour was 3140. Low High Machine-hours 51300 68400 Total factory overhead costs 222690 pesos 244920 pesos-----The factory overhead costs above consist of indirect materials rent and maintenance. A manufacturing company estimates semi-variable costs by using the high-low method with machine hours as the cost driver.

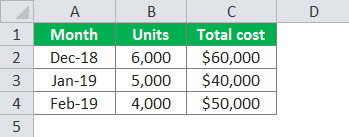

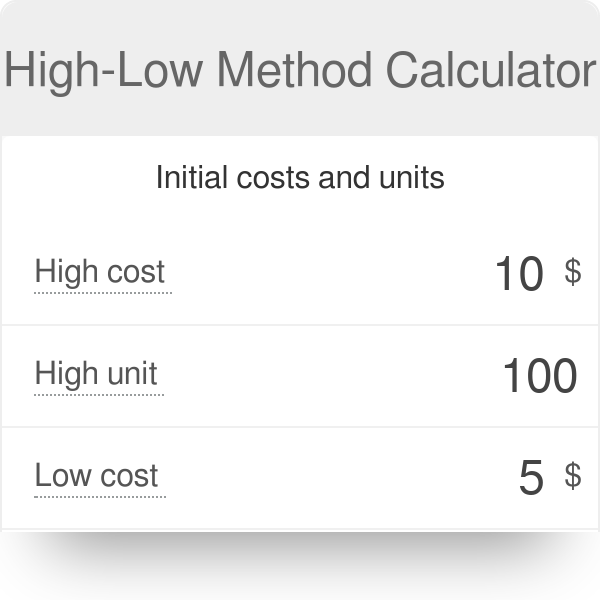

Hotlanta Inc which uses the high-low method to analyze cost behavior has determined that machine hours best explain the companys utilities cost. The high-low method uses two sets of numbers. Calculate variable cost per unit.

The companys relevant range of activity varies from a low of 600 machine hours to a high of 1200 machine hours with the following data being available for the first six months of the year. Barkoff Enterprises which uses the high-low method to analyze cost behavior has determined that machine hours best explain the companys utilities cost. Uses the highlow method to analyze cost behavior.

Variable Cost Per Unit. Uses the high-low method to analyze cost behavior. Construct total cost equation based on high-low calculations above.

Month Direct Labor Hours Maintenance Cost January 1700 14300 February 1900 15200 March 1800 16700 April 1600 14000 May 1500 14300 June 1300 13000 July 1100 12800 August 1400 14200 Required.

Pin On 2019 Upcoming Trending Styles

Datadash Com Method To Create A Dataframe In Numpy And Pandas U Machine Learning Artificial Intelligence Data Science Machine Learning

High Low Method In Accounting Definition Formula

Cost Behavior Analysis Analyzing Costs And Activities Example

High Low Method In Accounting Definition Formula

High Low Method In Accounting Definition Formula

High Low Method Learn How To Create A High Low Cost Model

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

Calculation Of Overhead Absorption Rate Basic Concepts Of Financial Accounting For Cpa Exam

High Low Method In Accounting Definition Formula

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

High Low Method Accounting Meaning Formula Example And More In 2021 Accounting Accounting Principles Accounting Education

The High Low Method For Analyzing Mixed Costs In Accounting Youtube

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

/cost-accounting-b615845be6d5418e8b79152f473a902f.jpg)